Projecting Your 2025 Retirement Income: A Step-by-Step Guide

Projecting your retirement income needs for 2025 involves estimating future expenses, accounting for inflation, and determining income sources like Social Security, pensions, and investments, ensuring a financially secure retirement through careful planning and adjustments.

Planning for retirement is crucial, and accurately projecting your retirement income needs for 2025: A step-by-step financial planning guide is a great way to ensure a comfortable and secure future. It’s about more than just guessing; it’s about building a solid financial roadmap.

Understanding the Basics of Retirement Income Planning

Retirement income planning is the process of estimating how much money you’ll need during retirement and determining how to generate that income. It’s a comprehensive approach that considers your future expenses, potential income sources, and the impact of inflation.

Effective retirement planning involves understanding various financial concepts and tools. From calculating your estimated expenses to exploring different investment options, each step plays a crucial role in securing your financial future.

Why is Retirement Income Planning Important?

Failing to plan adequately for retirement can lead to financial stress and a lower quality of life during your golden years. Proper planning helps you identify potential shortfalls and make necessary adjustments to ensure you have enough income to cover your expenses.

Key Components of Retirement Income

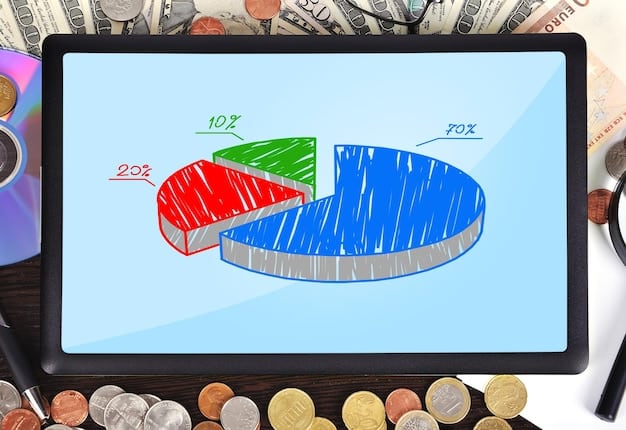

Understanding the different sources of retirement income is essential for creating a comprehensive plan. These sources typically include Social Security benefits, pensions, investment income, and savings.

- Social Security: A government program providing retirement benefits based on your work history.

- Pensions: Retirement plans offered by employers, providing a fixed income stream.

- Investments: Income generated from investments such as stocks, bonds, and mutual funds.

- Savings: Personal savings accumulated over time in retirement accounts like 401(k)s and IRAs.

By understanding these basics, you can start building a solid foundation for your retirement income plan. Each component contributes to your overall financial security, ensuring you can maintain your lifestyle during retirement.

In summary, grasping the fundamentals of retirement income planning is the first step towards a secure future. By understanding the key components and their importance, you can begin to create a personalized plan that meets your specific needs.

Step 1: Estimate Your Retirement Expenses for 2025

The first step in projecting your retirement income needs is to estimate your expenses. This involves identifying your current spending habits and anticipating how those expenses may change during retirement. This meticulous estimation forms the bedrock of effective retirement planning.

Accurately estimating your retirement expenses can be challenging, but it’s crucial to get a clear picture of your financial needs. Consider both essential and discretionary spending to ensure a comprehensive estimate.

Categories of Retirement Expenses

Retirement expenses can be broadly categorized into essential and discretionary. Essential expenses include housing, healthcare, food, and transportation, while discretionary expenses cover travel, entertainment, and hobbies.

Using Budgets to Plan

Creating a detailed budget is an effective way to track your current spending and project future expenses. Utilize budgeting tools, apps, or spreadsheets to monitor your income and expenses, providing a clear understanding of your financial habits.

- Track Current Spending: Monitor your current expenses to identify spending patterns.

- Identify Essential Expenses: Determine the minimum amount needed to cover essential needs.

- Estimate Discretionary Expenses: Allocate funds for leisure and hobbies, adjusting as needed.

- Review and Adjust: Regularly review your budget and make adjustments based on changing circumstances.

Estimating your retirement expenses accurately is a vital step in retirement planning. By considering all categories of expenses and using budgeting tools, you can create a realistic financial roadmap that supports your retirement goals.

In conclusion, accurately estimating your retirement expenses for 2025 is pivotal. By breaking down expenses into categories, utilizing budgeting tools, and regularly reviewing your estimates, you can create a reliable financial plan.

Step 2: Factor in Inflation and Healthcare Costs

Accounting for future inflation and rising healthcare costs is imperative when projecting your retirement income needs for 2025: A step-by-step financial planning guide. Failing to consider these factors can significantly impact your long-term financial security. Inflation erodes purchasing power and rising healthcare costs puts a potential strain on your retirement savings.

Inflation and healthcare costs are two critical variables that can significantly impact the value of your retirement savings. Planning for these factors ensures your retirement income keeps pace with the rising cost of living and protects against unexpected healthcare expenses.

Understanding Inflation Rates

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Monitoring inflation rates and projecting future increases is essential for accurate retirement planning. Historical inflation rates and economic forecasts can provide valuable insights.

Planning for Rising Healthcare Costs

Healthcare costs typically increase faster than the general inflation rate, making it crucial to allocate sufficient funds for medical expenses during retirement. Consider factors such as health insurance premiums, out-of-pocket expenses, and potential long-term care needs.

- Estimate Future Healthcare Needs: Consider your current health status and potential future medical needs.

- Factor in Health Insurance Premiums: Include expected health insurance costs in your budget.

- Account for Long-Term Care: Plan for potential long-term care expenses, such as nursing home care.

- Consider Medicare and Supplemental Insurance: Understand your Medicare coverage and explore supplemental insurance options.

Addressing inflation and healthcare costs ensures your retirement plan is resilient to economic changes and potential medical expenses. Staying proactive in managing these factors allows you to maintain financial stability throughout retirement.

To summarize, accounting for inflation and healthcare costs is paramount for projecting your retirement income needs. By understanding inflation rates and planning for rising healthcare costs, you can secure a more stable and predictable financial future.

Step 3: Determine Your Retirement Income Sources

Identifying and assessing all potential sources of retirement income is a fundamental step when projecting your retirement income needs for 2025: A step-by-step financial planning guide. By understanding your different income streams, you can create a balanced and sustainable financial plan.

Retirement income can come from various sources, including Social Security, pensions, investments, and savings. Each source has its own characteristics and potential benefits, requiring careful consideration.

Social Security Benefits

Social Security is a primary source of retirement income for many Americans. Understanding how your benefits are calculated and when to start receiving them is essential for maximizing your income stream. You can estimate your benefits using the Social Security Administration’s online calculator.

Pension Plans

If you have a pension plan from your employer, determine the amount of income you can expect to receive each month. Understand the terms of your pension, including any survivor benefits or cost-of-living adjustments.

Personal Investments and Savings

Investments and savings, such as 401(k)s, IRAs, and brokerage accounts, can provide significant income during retirement. Develop a withdrawal strategy that aligns with your income needs and risk tolerance. Consider consulting with a financial advisor to optimize your investment portfolio.

- Assess Investment Performance: Review the historical performance of your investments.

- Develop a Withdrawal Strategy: Determine how much to withdraw each year without depleting your savings too quickly.

- Account for Taxes: Understand the tax implications of withdrawing from different types of accounts.

- Diversify Investments: Maintain a diversified portfolio to manage risk and maximize returns.

Identifying and managing your income sources ensures a well-rounded retirement plan that meets your financial needs. Balancing these sources effectively allows you to maintain your lifestyle and achieve your retirement goals.

In conclusion, determining your retirement income sources is crucial for a comprehensive financial plan. By understanding Social Security benefits, pension plans, and personal investments, you can create a diversified and sustainable income stream for your retirement years.

Step 4: Estimate Your Social Security Benefits

Estimating your Social Security benefits is a critical step in projecting your retirement income needs for 2025: A step-by-step financial planning guide. These benefits often form a significant portion of your retirement income, making accurate estimation essential for effective planning.

Social Security benefits are based on your earnings history, and the amount you receive can vary depending on when you choose to start receiving benefits. Understanding these factors allows you to optimize your benefits and plan accordingly.

Factors Affecting Social Security Benefits

Several factors influence your Social Security benefits, including your earnings history, the age at which you begin receiving benefits, and any potential spousal or survivor benefits. Understanding these factors helps you estimate your benefits accurately.

Using the Social Security Administration (SSA) Calculator

The Social Security Administration provides an online calculator to estimate your retirement benefits accurately. This tool uses your earnings history to project your future benefits based on different retirement ages.

- Visit the SSA Website: Access the Social Security Administration’s website.

- Create an Account: Create an account or log in to your existing account.

- Use the Retirement Estimator: Enter your earnings history or allow the calculator to access it automatically.

- Review Estimated Benefits: View your estimated benefits at different retirement ages.

Estimating your Social Security benefits accurately helps you plan your retirement income strategy effectively. You can make informed decisions to help secure your financial future by understanding the factors that influence your benefits and utilizing the SSA’s online calculator.

To summarize, estimating your Social Security benefits is vital for projecting your retirement income needs. By understanding the factors that influence your benefits and using the SSA’s online calculator, you can create a more accurate and reliable retirement plan.

Step 5: Factor in Taxes

Tax planning is a fundamental aspect of projecting your retirement income needs for 2025: A step-by-step financial planning guide. Retirement income is often subject to taxation, and understanding these tax implications can optimize your financial strategy.

Taxes can significantly impact your retirement income, potentially reducing the amount of money available for your expenses. Understanding how your income will be taxed and developing a tax-efficient strategy can help maximize your retirement savings.

Understanding Taxes on Retirement Income

Different sources of retirement income are taxed differently. Social Security benefits, pension income, and withdrawals from retirement accounts are all subject to taxation. Understanding these tax rules helps you plan your withdrawals effectively.

Strategies for Tax-Efficient Retirement Planning

Several strategies can help minimize your tax burden during retirement. Consider tax-advantaged retirement accounts, Roth conversions, and strategic withdrawals to optimize your tax situation.

- Utilize Tax-Advantaged Accounts: Contribute to tax-deferred or tax-free retirement accounts.

- Consider Roth Conversions: Convert traditional IRA or 401(k) assets to a Roth IRA to pay taxes now and avoid them in retirement.

- Strategic Withdrawals: Plan your withdrawals to minimize your tax bracket.

- Consult with a Tax Advisor: Seek professional advice to optimize your tax strategy.

Addressing tax implications ensures your retirement income strategy is as efficient as possible. With careful planning and strategic decision-making, you can mitigate the impact of taxes and preserve more of your retirement savings.

In conclusion, factoring in taxes is crucial for projecting your retirement income needs. By understanding the tax implications of your income sources and implementing tax-efficient strategies, you can maximize your retirement savings and maintain financial security.

Step 6: Create a Retirement Budget and Monitor Progress

Developing a detailed retirement budget and regularly monitoring your progress is a crucial step in securing a financially stable retirement, as you retirement income needs for 2025: A step-by-step financial planning guide. A retirement budget helps you manage your income and expenses effectively, while monitoring progress ensures you stay on track towards your financial goals.

Creating a well-structured retirement budget provides a roadmap for managing your finances. Regular monitoring allows you to make timely adjustments to ensure you remain on course to meet your retirement objectives.

Developing Your Retirement Budget

Creating a comprehensive retirement budget involves compiling all your income sources, identifying your expenses, and balancing your inflows and outflows. Utilize budgeting tools or spreadsheets to create a detailed financial plan.

How to Track Investments

Tracking your progress towards your retirement goals involves monitoring your expenses against your budget, regularly reviewing your investment performance, and adjusting your strategy as needed. Regularly assess your progress to ensure you are on track to meet your financial objectives.

- Regularly Evaluate Expenses: Review your expenses regularly to identify areas for potential cost savings.

- Track Investment Performance: Monitor your investment portfolio’s performance to ensure it aligns with your risk tolerance and goals.

- Adjust Your Strategy: Make necessary adjustments to your budget and investment strategy based on changing circumstances.

- Seek Professional Assistance: Consult with a financial advisor to get personalized guidance and support.

Creating a solid budget and monitoring your progress ensures a resilient retirement strategy that adapts to changing circumstances. With consistent monitoring and timely adjustments, you can maintain control over your financial future.

In summary, creating a retirement budget and monitoring your progress are essential for securing a financially stable retirement. By developing a detailed budget and regularly tracking your progress, you can take control of your finances and achieve your retirement goals.

| Key Point | Brief Description |

|---|---|

| 💰 Estimate Expenses | Determine essential and discretionary costs to forecast retirement spending. |

| 📈 Factor Inflation | Account for rising costs to ensure savings maintain purchasing power. |

| 🛡️ Healthcare Costs | Plan for increased medical expenses during retirement. |

| 💸 Income Sources | Identify Social Security, pensions, and investments for income. |

FAQ

▼

Start by tracking your current spending habits. Then, adjust these expenses for retirement, considering factors like travel, healthcare, and lifestyle changes. Budgeting tools can help.

▼

Inflation erodes the purchasing power of your savings. It’s vital to factor in estimated inflation rates to ensure your income keeps pace with rising costs over time.

▼

Use the Social Security Administration’s online calculator to estimate your benefits. This tool uses your earnings history to project your future benefits based on different retirement ages.

▼

Consider contributing to tax-advantaged accounts, Roth conversions, and strategic withdrawals to minimize your tax burden during retirement. Consult with a tax advisor for personalized guidance.

▼

You should review your retirement budget at least annually, or more frequently if there are significant changes in your income, expenses, or financial goals. This helps ensure you stay on track.

Conclusion

Accurately projecting your retirement income needs for 2025 involves careful planning, detailed estimation, and consistent monitoring. By following these steps, you can create a solid financial roadmap and enjoy a secure and comfortable retirement.